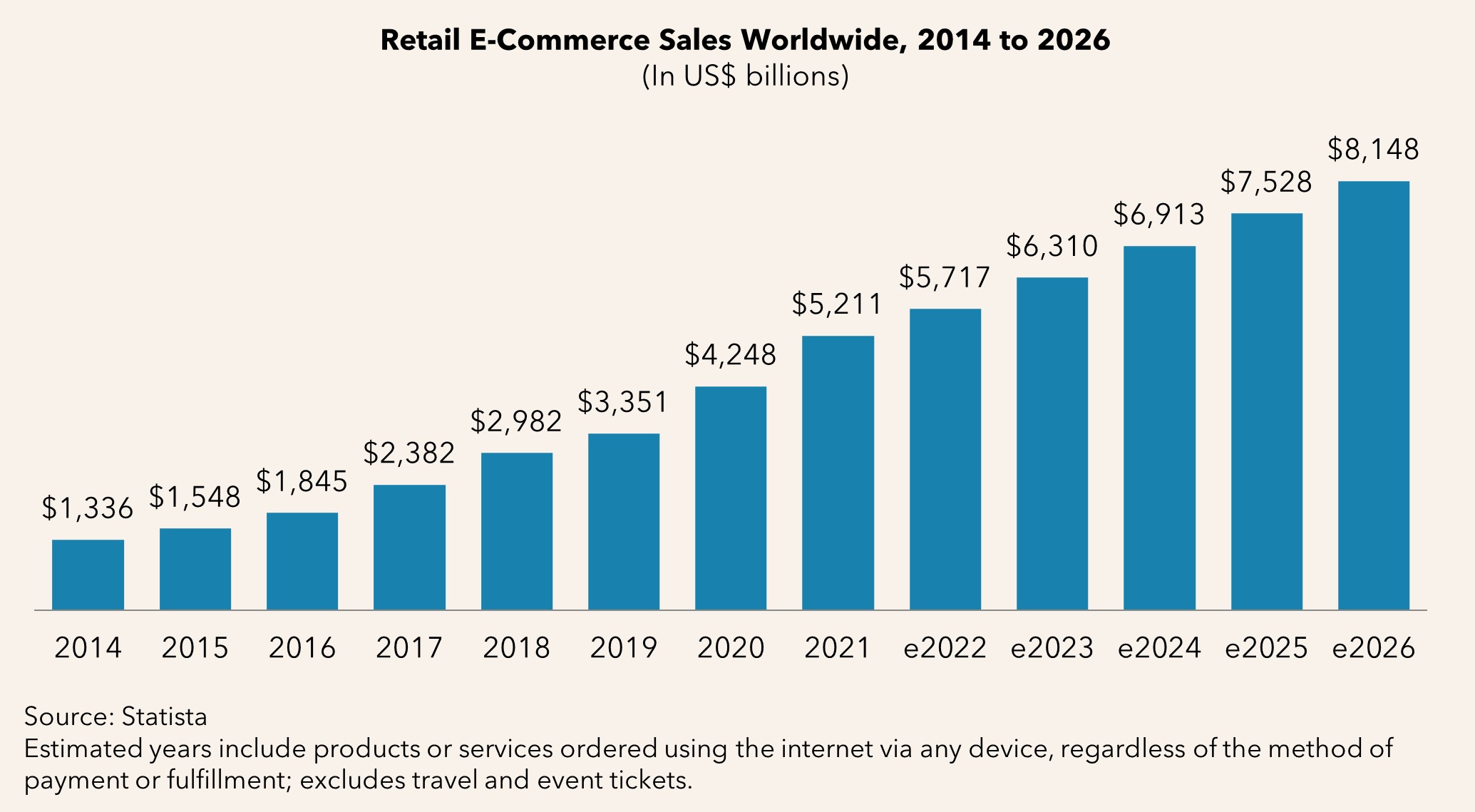

E-commerce sales continue to increase annually, and billions of dollars are lost each year to CNP fraud. EMV chip cards have significantly reduced in-store fraud losses, thus driving fraudsters to the online channel in which chip technology does not offer protection. The 3DS specification provides a way to protect e‑commerce transactions and increased authorization rates, when used appropriately. 3DS is widely supported globally among issuers, merchants, payment processors, and other industry players.

This report explores FI experiences and attitudes with CNP fraud and 3DS and looks at those industry forces that may impact this standard and its usage in the future. This report is based on research sponsored by Outseer. In Q3 2023, Datos Insights interviewed fraud executives at 20 FIs to assess their CNP fraud and 3DS usage and experiences, authorization approval rates, fraud losses, and thoughts on emerging technologies that have the potential to impact 3DS. FIs were located in Australia, Canada, Germany, the U.K., and the U.S.

Clients of Datos Insights’ Fraud & AML service can download this report.

This report mentions American Express, Discover, EMVCo, JCB, Mastercard, and Visa.

About the Author

David Mattei

David Mattei is a Strategic Advisor at Datos Insights in the Fraud & AML practice. David has over 15 years of experience in the payments industry designing, building, and launching fraud and dispute systems. Fraud constantly poses financial and reputational risks to parties on both sides of a transaction, and David's customers have included merchants and financial institutions, giving him...

Other Authors

Julie Conroy

Julie Conroy serves as the Chief Insights Officer for Datos Insights. Prior to Julie’s tenure at Datos Insights, she had more than a decade of hands-on product management experience working with financial institutions, payments processors, and risk management companies. She spent a number of years as Vice President of Product Solutions with Early Warning Services, where her team managed a...